TURKISH PPPI EXPERIENCE CASTS LONG AND DARK SHADOWS ON PPPI MODEL

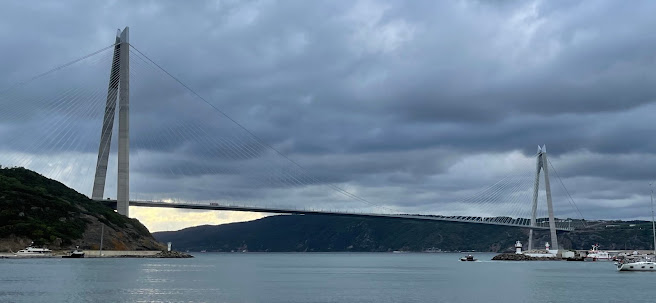

Yavuz Sultan Selim Bridge at the northern tip of Bosphorus. Copyright: Ahmet Söylemezoğlu

A large volume of infrastructure has been built based on the Public-Private-Partnership (PPPI) model in many countries. These projects offer important lessons and insights about this model. Among the many countries which have used the PPPI instrument, Turkey has a distinct place as it relied on the PPPI model heavily, perhaps more than any other emerging market and/or middle income country. Turkish experience is noteworthy not only in terms of its volume but also in terms of its breadth as Turkish PPPI projects spreads virtually over all sectors.

This blog after some remarks about the PPPI projects and some of the pitfalls associated with them provides a comparative picture of the scale of PPPI projects in Turkey with those of in China, India Brazil, Indonesia, Philippines, Mexico, Thailand and Malaysia. It concludes with some of the lessons emerging from the Turkish experience.

Factors Behind PPPI Momentum and Pitfalls

Infrastructure investments based on the Public-Private-Partnership model have existed in some form throughout history. However, the PPPI projects have become especially popular over the last thirty years or so. In fact, the PPPI model became the main instrument for infrastructure investments in some countries and in some sectors. The popularity of the PPPI projects were fueled by the following factors:

- A long-lasting global liquidity glut

- Very low interest rates in the developed countries

- General acceptance of privatization as the anchor policy choice for economic efficiency and development

- Highly effective support given by the development finance institutions, such as the World Bank, to the PPPI model and the PPPI projects

- Huge appetite shown by commercial financial institutions towards the PPPI projects which offered attractive returns with sovereign guarantees.

- In many countries, governments interpreted the PPPI model as a way out of well-established procurement and contract laws and procedures. Hence, they found a vast discretionary space within the PPPI project domain.

- The PPPI model effectively provided extra fiscal space and without any immediate burden on the current budget. Thus, politicians jumped on the opportunity to do more with the same fiscal revenue.

- Lack of transparency in PPPI projects raised the possibility of serious corruption.

- Fiscal risk management often overlooked at during the PPPI process. Consequently, PPPI projects narrowed the future fiscal space and placed big burden on the future budgets.

- Project design stage is plagued by highly optimistic expectations and unrealistic cost assumptions. Hence, the fiscal burden is frequently underestimated. Frequent and substantial cost and concession revisions generated doubts about the integrity of the project design, award and implementation stages.

- Financial risks, especially foreign exchange rate risks, are not well mitigated.

- Relatively large PPPI projects created concentrated economic benefits to a few groups/people and thus distorted overall competitive climate of the economy.

- Large opportunity costs effectively taxed overall economic productivity.

Turkish Experience

Turkey implemented 253 PPPI projects in all sectors, excluding health sector, with total value of about $146 billion since 1990 (World Bank PPPI data base figures). However, the bulk of these projects were done since 2002 by the current AKP government. Turkey has embarked on 237 projects valued at $136.3 billion since 2002 as shown in table below. A closer examination of this table shows that Turkey’s PPPI project portfolio increased significantly between 2006 -2015. 178 projects were implemented during this period. Almost eighty percent of the projects in terms of value were carried out between 2011 -20015. Hence, one could say that the five-year period between 2011 – 2015 is the golden age of PPPI in Turkey.

As seen figure below, most of the Turkish PPPI projects are in power sector. However, relatively small number of airports projects (13 in total) and highway projects (9 in total) have a bigger value than the total 186 power projects ($67 billion vs $58 billion). As noted above these figures do not include health sector projects. Turkey also implemented several hospital projects (so-called “city hospitals”) based on the PPPI model. Actual figures for hospital projects varied and the World Bank PPPI data base does not include them. Conservative estimates of the hospital projects are around $25 billion.

Turkey certainly is not alone in implementing PPPI projects. The table below shows key PPPI portfolio figures (number of projects and the monetary value) of some important and comparable emerging markets/middle income countries since 2002. In terms of value, Brazil leads the pack with $267.2 billion dollar PPPI portfolio followed by India with a $260.2 billion. Turkey comes forth with $136.3 billion after China whose PPPI portfolio is valued at $184.2 billion.

To have a better picture of the intensity of the use of PPPI model in Turkey, the following table compares the PPPI volumes of Turkey and other emerging/middle income countries with respect to their population and GDPs . The ratios are constructed by using 2020 GDP and population figures.

As shown above, Turkey leads all the comparative countries, followed by Brazil, for both measures by a considerable margin. In fact, Turkey has done about 33% more PPPI projects than Brazil compare to their respective population size. In terms of GDP, Turkey has done 20% more than Brazil. Turkish PPPI projects are ten times more than that of China and eight times more than that of India considering the respective populations of these two countries.

Another interesting feature of the Turkish PPPI portfolio is the relatively high average project size as shown table below. Average value of Turkish PPPI projects is $575 million compared to that of Indonesia’s $520 million. Brazil which has the second highest PPPI volume considering the population and GDP has an average project size of $334 million.

Turkey’s very high average project value should not be surprising. As noted earlier, Turkey has embarked on very large airport and highway projects. Highway projects includes three of the longest suspension bridges in the world (third Bosphorus bridge, bridge over Gemlik Bay and the Dardanelles bridge) and an undersea tunnel crossing Bosphorus (Eurasia tunnel). Airport projects include new Istanbul Airport which is one of the biggest in the world.

In addition to the PPPI project portfolio mentioned above, Turkey built so-called “city hospitals” in various cities based on the PPPI model. These are also rather big (totaling more than 30,000 bed capacity) and sophisticated hospitals. The value of these hospital projects varied. Most conservative estimates are valuing them at least at $25 billion. Figures as high as $65 billion mentioned for these hospitals.

Lessons

Turkish PPPI project portfolio is impressive in many respects. Not only the Turkish PPPI portfolio contains numerous projects valued at more than $150 billion (including the hospitals) but it also includes some of the largest and the most ambitious infrastructure projects anywhere in the World. Yet, these projects have been the subject of a very harsh political debate as they are being blamed for the considerable part of the economic difficulties that Turkey faces today. In fact, the expected benefits from these projects have not been realized so far but they have already imposed significant burden on the fiscal space and undermined the overall economic productivity. Furthermore, the fiscal burden is likely to linger on for the foreseeable future. Therefore, the PPPI projects will undoubtedly become one of hottest issues during the next elections.

The following summarizes the discussions around the PPPI portfolio and the emerging problems associated with these projects in Turkey:

a) The government continuously rejects detailed disclosure about the projects based on so-called “private commercial information” argument. Therefore, the public knows very little about these projects. The information regarding their actual total costs, contingent liabilities arising from them and their future burden on the budget is quite sketchy. Hence, it attracts a lot of speculation. This issue was also raised by the IMF during the most recent Article IV consultations.

b) Decisions on these projects were taken solely by the executive branch. There has been virtually no effective involvement by the parliament during the decision stages nor has there been effective parliamentary oversight on these projects. In addition, there was no public discussion on them prior to the decision nor was there any stakeholder involvement during the preparatory stages. In fact, the lack of parliamentary oversight has been justified by the government on the grounds that these projects are PPPI projects. Hence, the PPPI model has been presented as if it excludes proper disclosure, public debate and parliamentary oversight.

c) Most of these projects have now reached to operational stage and they are operating at a fraction of their capacity. The main reason for this situation is the excessively high fees and user costs given the level of disposable income and considerably less costs of alternatives. For example, you can buy air tickets for three people between Istanbul and Izmir (about one hour flight) less than Istanbul – Izmir highway tolls, including the toll for Osman Gazi Bridge (over Gemlik Bay) and gas expenses. Monthly toll for Eurasia tunnel between Asian and European sides of Istanbul is more than minimum monthly wage. New Istanbul Airport imposes large charges on tickets and services. Consequently, the government is making huge payments to the PPPI contractors for the unused but guaranteed capacity. In addition, the government is making various direct and indirect regulations to force people to use these highways, airports and other services to reduce its own outlays.

d) There have been various reports indicating the costs of these projects were revised upwards after awarding the contracts and subsequently the contractors were given additional concessions. Furthermore, some reports indicate that projects were revised in such a way that the costs were reduced without any corresponding reduction in the concessions (for example Istanbul Airport project was reportedly subjected to significant revisions by reducing the elevation of the runways hence cutting huge amount of civil works). The government refused to answer all these claims based on again “privacy” considerations.

e) Virtually all mega projects were given to the same pool of contractors (so-called “five contractors”). Therefore, private benefits of such a huge portfolio concentrated within a very few businesses. In fact, these five companies are now listed among the world’s top ten most public sector tender-winning companies by the World Bank. This situation obviously created a “privileged” group of companies in Turkey and distorted overall competitive business environment.

f) Either US dollars or Euros were used in all Turkish PPPI projects. Thus, the contractors’ income guaranteed in these currencies. As Turkish lira lost almost half of its value in real terms (or about 300% in nominal terms) over the last five years, the fees which were set at the beginning became unaffordable by Turkish public. Therefore, the government had not only to pay higher local currency amounts in lieu of the unfulfilled capacity in these projects but it had to subsidize user fees as well to prevent rather absurd fees in Turkish liras. This situation aggravated the budgetary burden even further. Currently, government is subsidizing up to fifty percent in some projects yet the fees are still excessively high as described in (b) above.

g) Turkey's economic productivity has been sliding since 2006 and this decline has even been accelerated since 2010. The decline in overall productivity is also coincided with the "PPPI rush" period. Given the capacity redundancies and the huge costs of these projects, the opportunity cost of capital tied to these projects are immense. These projects taxed heavily Turkish country limits of international financial institutions leaving relatively little room for other and more productive projects.

h) It appears that political risks of the significant portion of the Turkish PPPI portfolio are covered by some international institutions such as MIGA and international arbitration is the venue for the dispute settlement. Given the tone and the intensity of the current political debate, it is more than likely that these projects will be subjected to a close scrutiny should a change in government occur. Thus, any dispute between the contractors and the future governments will unavoidably bring these international organizations along with the international lenders into these disputes.

b) Decisions on these projects were taken solely by the executive branch. There has been virtually no effective involvement by the parliament during the decision stages nor has there been effective parliamentary oversight on these projects. In addition, there was no public discussion on them prior to the decision nor was there any stakeholder involvement during the preparatory stages. In fact, the lack of parliamentary oversight has been justified by the government on the grounds that these projects are PPPI projects. Hence, the PPPI model has been presented as if it excludes proper disclosure, public debate and parliamentary oversight.

c) Most of these projects have now reached to operational stage and they are operating at a fraction of their capacity. The main reason for this situation is the excessively high fees and user costs given the level of disposable income and considerably less costs of alternatives. For example, you can buy air tickets for three people between Istanbul and Izmir (about one hour flight) less than Istanbul – Izmir highway tolls, including the toll for Osman Gazi Bridge (over Gemlik Bay) and gas expenses. Monthly toll for Eurasia tunnel between Asian and European sides of Istanbul is more than minimum monthly wage. New Istanbul Airport imposes large charges on tickets and services. Consequently, the government is making huge payments to the PPPI contractors for the unused but guaranteed capacity. In addition, the government is making various direct and indirect regulations to force people to use these highways, airports and other services to reduce its own outlays.

d) There have been various reports indicating the costs of these projects were revised upwards after awarding the contracts and subsequently the contractors were given additional concessions. Furthermore, some reports indicate that projects were revised in such a way that the costs were reduced without any corresponding reduction in the concessions (for example Istanbul Airport project was reportedly subjected to significant revisions by reducing the elevation of the runways hence cutting huge amount of civil works). The government refused to answer all these claims based on again “privacy” considerations.

e) Virtually all mega projects were given to the same pool of contractors (so-called “five contractors”). Therefore, private benefits of such a huge portfolio concentrated within a very few businesses. In fact, these five companies are now listed among the world’s top ten most public sector tender-winning companies by the World Bank. This situation obviously created a “privileged” group of companies in Turkey and distorted overall competitive business environment.

f) Either US dollars or Euros were used in all Turkish PPPI projects. Thus, the contractors’ income guaranteed in these currencies. As Turkish lira lost almost half of its value in real terms (or about 300% in nominal terms) over the last five years, the fees which were set at the beginning became unaffordable by Turkish public. Therefore, the government had not only to pay higher local currency amounts in lieu of the unfulfilled capacity in these projects but it had to subsidize user fees as well to prevent rather absurd fees in Turkish liras. This situation aggravated the budgetary burden even further. Currently, government is subsidizing up to fifty percent in some projects yet the fees are still excessively high as described in (b) above.

g) Turkey's economic productivity has been sliding since 2006 and this decline has even been accelerated since 2010. The decline in overall productivity is also coincided with the "PPPI rush" period. Given the capacity redundancies and the huge costs of these projects, the opportunity cost of capital tied to these projects are immense. These projects taxed heavily Turkish country limits of international financial institutions leaving relatively little room for other and more productive projects.

h) It appears that political risks of the significant portion of the Turkish PPPI portfolio are covered by some international institutions such as MIGA and international arbitration is the venue for the dispute settlement. Given the tone and the intensity of the current political debate, it is more than likely that these projects will be subjected to a close scrutiny should a change in government occur. Thus, any dispute between the contractors and the future governments will unavoidably bring these international organizations along with the international lenders into these disputes.

Turkish experience as summarized above includes just about every argument against the PPPI model. The PPPI model in Turkey now is a tainted model and it lost credibility in the eyes of general Turkish public. There has been notable reversal even in the government circles as the Minister of Heath made a remark about abandoning the PPPI model altogether.

Conclusion

There is no doubt that the PPPI is a powerful model to expand the infrastructure investments. However, it is not easy to implement. Even in countries such as Turkey which has considerable human resource and institutional capacity the PPPI model can yield disastrous results. In order to mitigate all the risk factors associated with the PPPI process, the following is suggested:

- The PPPI process involves very complex conflicts of various interests in all stages. These conflicts must be identified and the appropriate governing mechanisms must be defined prior to engaging in these projects.

- The PPPI projects must be decided and managed as a portfolio. The public finance and debt management experts should be involved at all stages.

- The PPPI contract awarding and management stages must comply with the main principles of the established universal procurement rules. Discretionary space should be as minimum as possible and the guiding principles for the discretionary actions and the required public disclosures of them should also be set forth from the very beginning.

- The interest of the public at large should be recognized. Thus, proper disclosure policies and effective parliamentary oversight must be established.

- The PPPI projects include serious moral-hazard possibilities for all the parties involved. Therefore, international financial institutions of all types (multilateral development finance institutions, commercial lenders, multilateral, bilateral and commercial and political risk underwriters of all sorts, etc.) should be very careful in engaging in these types of projects as they are potential source of "reputational risk".

Yorumlar

Yorum Gönder